Author: Jo-Jo Hubbard, CEO and Co-Founder of Electron

Net Zero energy depends on flexibility from clean, distributed energy assets. Currently, around two thirds of the flexibility that our energy system needs to balance supply and demand, especially around the variable output of wind and solar, comes from gas.

That means that gas continues to set the marginal price for peak energy. Consumers are stuck with the rising cost of system stability, as opposed to cheap, abundant renewable power.

Clean alternatives – think distributed flexibility from battery storage and flexible demand from electric cars, heating, and industrial processes, etc – are struggling to connect to increasingly congested electricity grids.

Those that have connected remain, predominantly, outside flexibility markets.

To achieve Net Zero energy by 2035, we need to scale flexibility markets, fast. But how do we do that and why hasn’t it already happened?

Flexibility Service Providers need more value to attribute more volume…

Flexible Service Providers (FSPs) need to see more value from flexibility to deliver more MWs to market. Some early movers have made the time and technology investments to bet on the expansion of today’s flexibility markets.

However, participation gaps between these same markets suggests that the vast majority are still sitting on the side lines. (For example, the participation gaps between the Electricity System Operator’s Balancing Market and the Optional Downwards Flexibility Market in 2020, or the Demand Flexibility Service in Winter 22/23).

Participating is simply not deemed worth the pain of market discovery, asset monitoring and control system installation, market qualification, etc. And that’s just for the flexible assets that are already built.

Large, valuable flexibility markets could lower asset financing costs, thereby transforming the business case for new clean energy assets. This would create GWs of new flexibility to participate in markets.

In turn, the flexibility of these assets could be leveraged to reduce peak strain on their local networks and – you guessed it – connect new clean energy assets to the same grid, even faster.

… and System Operators need more volume to attribute more value

Conversely, System Operators (SOs) need to see more volume from flexibility before attributing more value to it.

They cannot delay a fraction of the network reinforcement: it’s all or nothing. Likewise, they cannot ask for new capacity to be built in stages as flex volume scales: it’s uneconomic. Locational flexibility markets need to reach sufficient liquidity to unlock this inherent value.

Moreover, gas prices will continue to dictate balancing costs until gas peakers are squeezed out of the system by cleaner, lower cost alternatives.

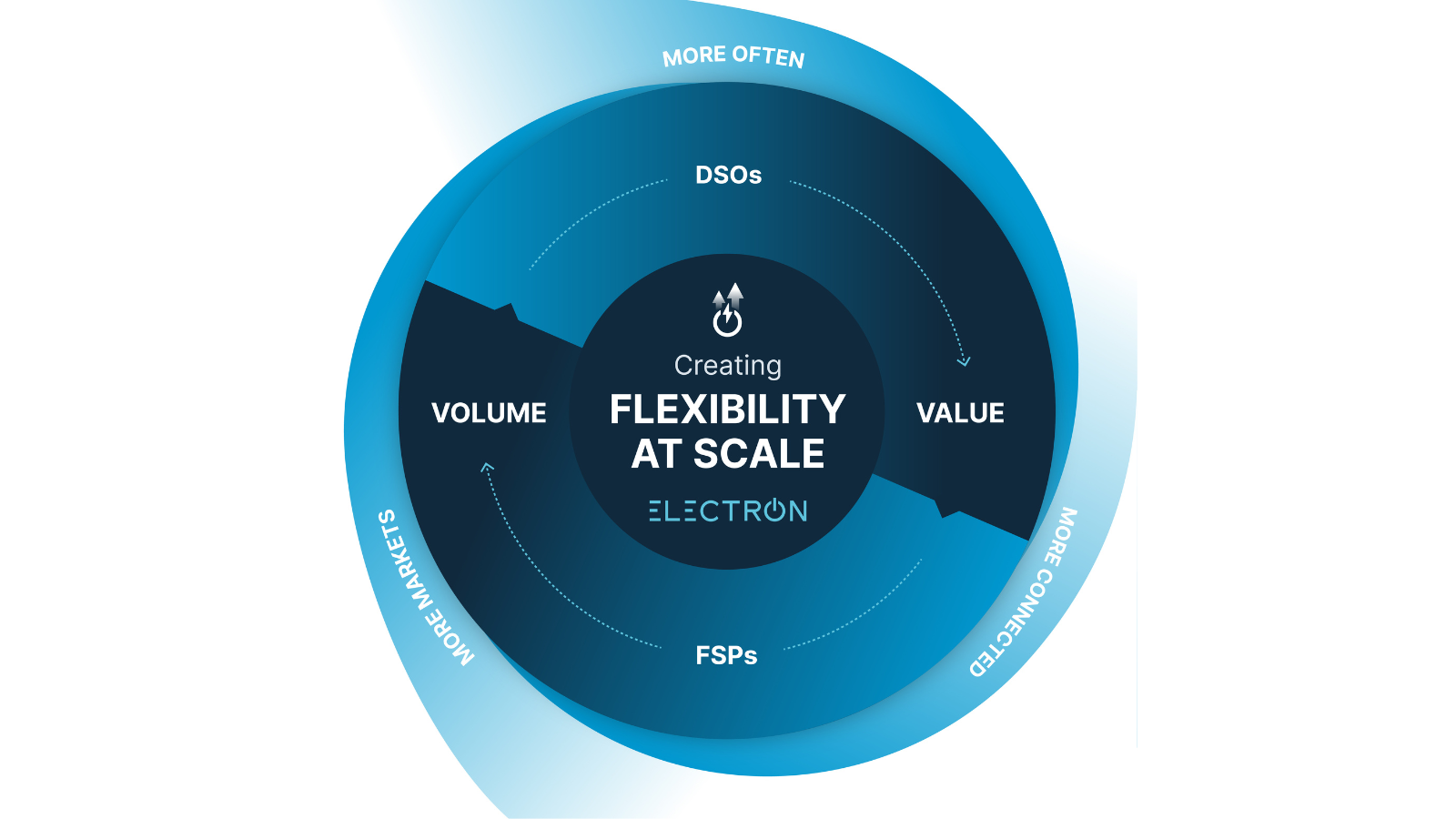

Value and volume have a flywheel effect

Value begets volume and volume begets value for flexibility. The relationship is symbiotic.

Since the total value of flexibility markets = Value x Volume, this is a market primed for exponential growth – if we can get the growth conditions right.

Unsurprisingly, there is no silver bullet. Markets take time to develop liquidity. There’s no single capital expenditure lever that any government can pull – and that’s why flexibility is so often left out of policy headlines.

But it is hugely in the interest of both SOs and FSPs to nudge value and volume incrementally up until the virtuous circle starts to turn with its own momentum.

It’s in the gift of next-generation flexibility market platforms, like ElectronConnect, to grease this fly wheel and make it turn faster.

Technology platforms can drive the compounding effect

The first generation of flexibility procurement tools helped improve the visibility of flexibility opportunities. That stimulated the initial market through simple signposting via sign-up portals and webforms.

But, due to the static nature of these tools, they were unable to streamline the rest of the user journey. Sign-up, qualification, bidding, dispatch and settlement processes all remained as manual steps, heavily reliant on spreadsheets and off-system workarounds.

As well as creating friction (and therefore cost) in participation and market operation, the monolithic design of these applications also meant that data became siloed. This lack of portability of data has limited market interoperability and the opportunity for value stacking across services.

Finally, the lack of integration and automation placed an artificial ceiling on flex market scale, because a disproportionate burden of operational overhead was placed on SO users.

Addressing these challenges has been the core focus of next-generation flexibility market platforms, like ElectronConnect. This aims to create and concentrate new value, greasing the flywheel and setting it spinning faster.

As such, we designed ElectronConnect around three core propositions:

1. More markets

The first thing needed to get this flywheel spinning is pull as much flexibility (liquidity) into the system as possible. This means meeting the differing needs of SOs, FSPs, and, in the future, other energy assets with trapped generation/ capacity. Our configurable software system can host multiple products and services on a single platform.

Then we need to enable FSPs to extract the maximum value from these markets. This means defining which tradeable products must be treated as exclusive options for a single player and which can be jointly accessed.

ElectronConnect can coordinate between markets and network systems to enable the optimal outcome for flexibility. This will ultimately allow FSPs to access and stack the value of multiple markets together (as service design permits).

2. More often

ElectronConnect allows for day-ahead and integrated real-time trading. We make these timeframes feasible for SOs through industry- leading OT integration capabilities (e.g. with Active Network Managements and dispatch systems) and automation.

This reduces the friction and additional overheads associated with near real-time market operations, increasing their net value release.

For FSPs, this unlocks new flexible capacity from assets such as batteries unwilling to commit to one flexibility market over another until the day or hour ahead of delivery; or perhaps electric vehicle aggregators unable to commit to capacity availability six months or one month ahead of planned usage.

3. More connected

Finally, we seek to increase the value of the markets we host by making it easier to sign up to and extract data insights. We profoundly believe that this is best accomplished through an open-ecosystem approach.

Regarding upstream FSP / asset data, we are integrating with multiple asset datasets and market sign-up portals to expedite market entries. We are also collaborating with Arup and Energy System Catapult to develop an open blueprint for portable asset data between market platforms.

With regards to downstream market/ trading data: we operate on an enhanced data ownership and services model that will allow multiple third parties and service providers to connect additional services and insights, such as new baselining methodologies or behavioural forecasts.

Huge growth opportunity for early movers

The tricky thing about markets – and flexibility is no exception – is that they don’t start with all the volume on day one. We need to establish price signals and a trading track record to get new flexible assets funded and into markets.

The good thing about markets – particularly those hosted on platforms designed to magnify value creation – is that they see compounded growth.

System stakeholders therefore need to consider the long-term business case. If you start a new flexibility market on a platform like ElectronConnect a year ahead of another System Operator, you’re incrementally further ahead on savings as each year compounds.

The value you extract from flexibility markets will prosper as more FSPs engage – kick-starting that flywheel – and Net Zero energy becomes ever more attainable.