BiTraDER is developing a near real-time market to reduce the risk of curtailment. It will achieve this by linking ENWL’s Active Network Management and dispatch systems with Electron’s multi-market platform, ElectronConnect.

Integrating those systems, and associated services, provides the basis for multilateral optimisation of renewable generation and network capacity amongst Distributed Energy Resources (DERs).

It will also support nearer real-time trading and scale (both participation and volume) in distribution-level flexibility marketplaces.

The overarching goal of BiTraDER is therefore twofold:

- Establishing an asset-to-asset market for distribution-level curtailment obligations

- Creating a new generation of integrated flexibility within an architecture that supports an ecosystem of third-party market platforms and services

Download a free infographic explainer for BiTraDER

Towards Net Zero grid operation

In the world’s transition to a Net Zero electricity system, networks are faced with a rapid increase in:

- distributed variable generation

- consumer demand, through electrification

- connection requests for new DERs

Addressed in isolation, these trends present a substantial challenge to DNOs. However, addressed collectively, this presents an opportunity to match new electrified demand with variable supply to:

- enable faster connections

- unlock more grid flexibility

- save consumers money

The role of curtailable connections

One of the key tools to unlock these benefits is the concept of curtailable connections. These connections curtail DERs from exporting their full capacity under certain conditions, i.e. when the grid is overloaded.

However, accepting a curtailable connection carries the risk of curtailment at times of network capacity stress for new connectees. Without a local curtailment market, the connectee has no way to manage that risk.

Local DERs with non-curtailable connections also want to find ways to solve and monetise network congestion.

The BiTraDER curtailment market offers a solution to these challenges.

BiTraDER: An overview

BiTraDER aims to investigate, develop, and trial – live on ENWL’s DNO network – a flexibility market for curtailment obligation trading.

It will enable DERs with curtailable connections to avoid curtailment by paying DERs with non-curtailable connections to alter their planned use of the system:

- For generators with a curtailable connection: this means paying for generation turn down or demand turn up

- For demand assets with a curtailable connection: this means paying for demand turn down or generation turn up

Within this market, non-curtailable energy resources will be able to access more revenue streams and provide more flexibility services than ever before. At the same time, curtailable DERs can avoid curtailment. It will also reduce barriers to entry to new flexibility markets, helping to supplement the volumes of flexibility available across ENWL’s network.

The project aims to assess the following factors, to test relevance for future scenarios:

- The appetite for this type of bilateral trading market

- The data needed to support how the market runs

- The interfaces needed to ensure visibility over the relevant information

- Bilateral trading market rules

- How possible it would be to run the marketplace in close to real time

How the BiTraDER curtailment market works

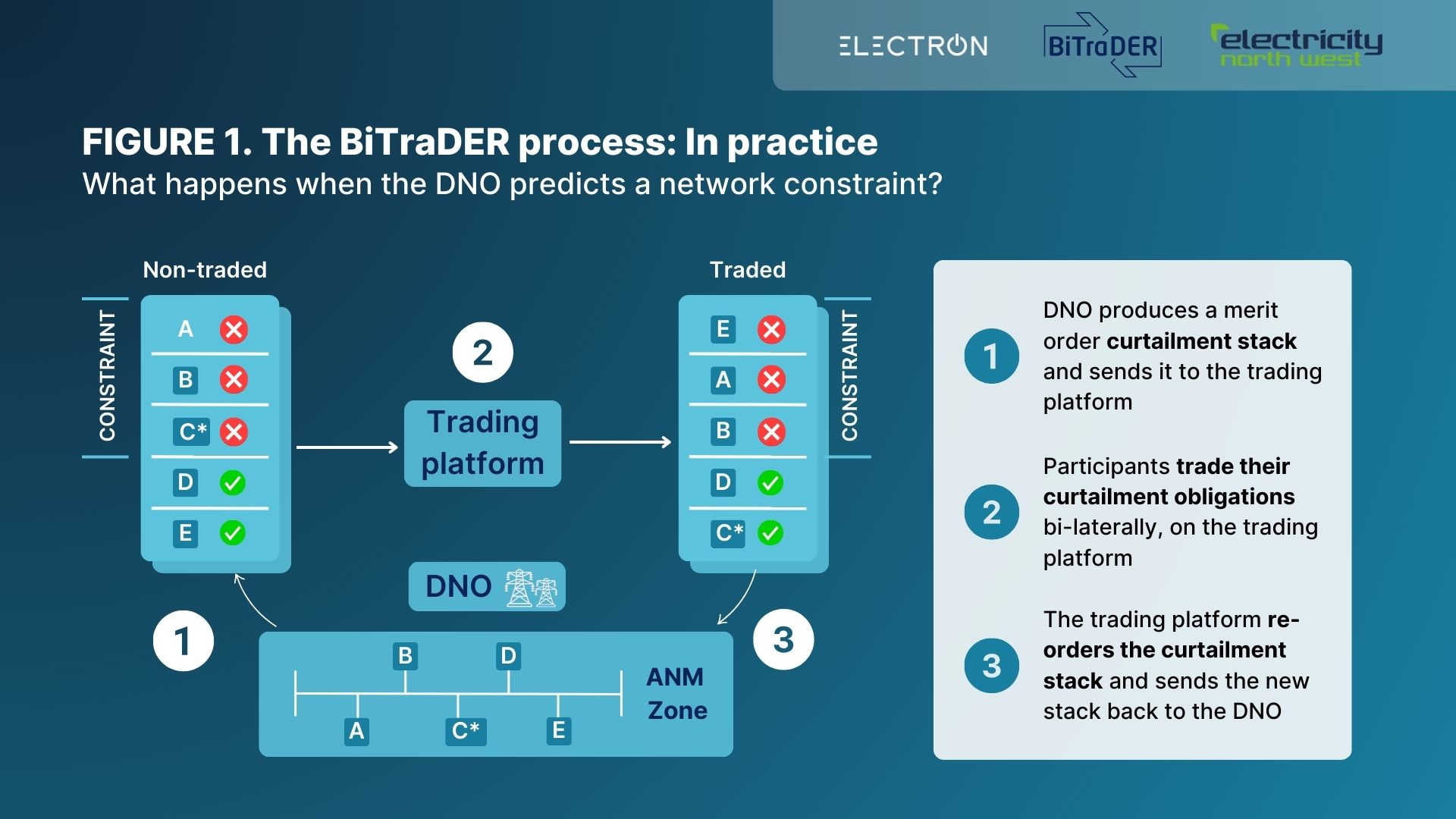

In practical terms, ENWL will share a merit order stack – a list of energy resources which can be used to resolve a constraint – with the market through BiTraDER. The stack will be based on predictions around network constraints.

The neutral market platform – ElectronConnect – then enables DERs to trade their curtailment obligations bilaterally in the stack. After gate closure, the DNO will get the traded stack back. This traded stack is used for dispatch by the DNO if the constraint manifests (see Figure 1).

Towards a blueprint for scaling and integrating third-party market platforms with network operating systems

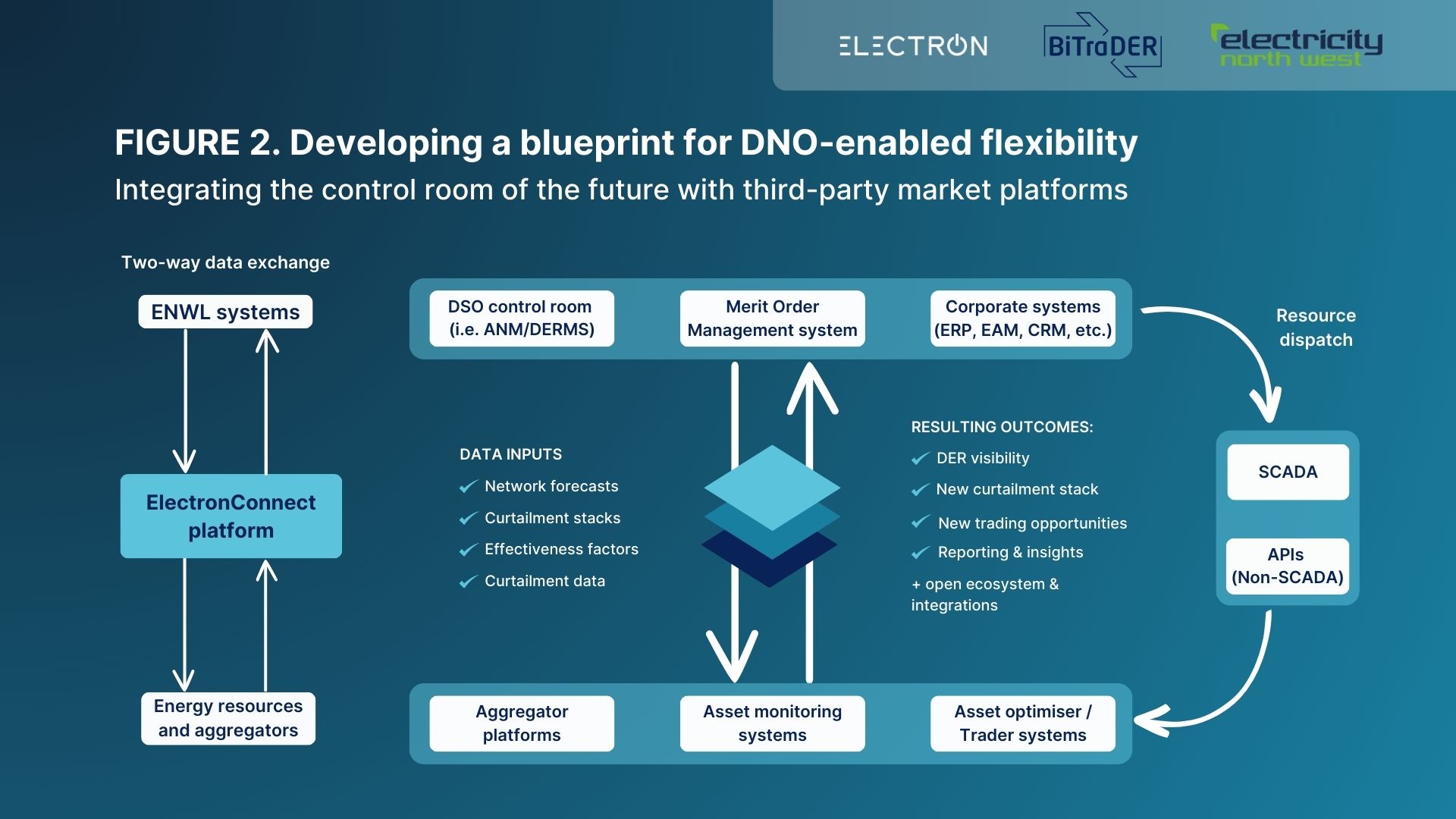

To develop this new, dynamic, nearer real-time market, a large part of the project workstream is dedicated to integrating ENWL’s monitoring and control systems and dispatch system with ElectronConnect, our trading platform.

While near real-time flexibility trading is not a new concept, the degree of operational integration – facilitated through ElectronConnect – enables these new markets to scale and capture the full value of local network optimisation, for both the DNO and locally connected DERs.

As such, BiTraDER’s integration of this new flexibility market proposes a new standard for flexibility market trading going forwards: a high level of integration between the third-party market platforms and services to allow the two-way data flows that are vital for multilateral network capacity optimisation (see Figure 2).

This involves:

- Getting the information on network constraints to the DERs and aggregators

- Feeding this back into the ENWL’s network management systems to enable dispatching

An ecosystem of services for additional information and integrations

This integration of information with the DNO’s operating system unlocks more than just flexibility trading at scale.

BiTraDER’s architecture will enable an ecosystem of new services and third-party platforms – to integrate with ENWL’s network data and ElectronConnect’s market data. This will bring buyers, sellers, and managers of flexibility access to more data insights, such as weather and behavioural forecasts.

This blueprint is therefore essential to Net Zero grid optimisation. Optimising the use of a distributed variable grid is simply not possible without this first-of-its-kind, two-way data exchange that is both integrated and scalable.

BiTraDER will therefore help ensure DNOs access the right volumes of flexibility, at the right times and places into the future.