From a focus on how flexibility can contribute to affordability and reliability to the potential of the distribution system operator (DSO) function in the USA, here are some of the 2025 flexible energy predictions from the experts:

- Flexibility will increasingly support affordability and grid reliability

- The UK will continue its focus on operational standardisation and interoperability to boost participation in flex markets

- The EU Network Code on Demand Response will advance

- FERC 2222 and 1920 signal a growing requirement on US utilities to integrate renewables into the grid

- The ability and need to access new markets for DERs will only grow

- US utilities are starting to recognise the potential of distribution system operator (DSO) capabilities for leveraging DERs

1. Flexibility will increasingly support affordability and grid reliability

“The theme for flexibility and the energy market in 2024 has been about the rapid expansion of generation and network capacity,” says Jo-Jo Hubbard, CEO and Co-Founder of Electron. “Affordability and reliability will therefore be coming more under the spotlight in 2025 – and it all needs to go much faster.”

Global demand for electricity is growing. In the US, there’s renewed focus on energy security. The 2023 EU Action Plan for Grids points to the need to create smarter grids. Ofgem’s consultation on a framework for the next price control period in the UK – to come into play in 2028 – proposes introducing penalties for not building fast enough. This is instead of penalising inefficiency as is the case in the current price control period.

“In 2024, we’ve heard a lot about data centres, reshoring of industry, and how that’s affecting load growth forecasts. We’ve been talking about the importance of the energy grid to underpinning GDP,” says Jo-Jo.

“Any domestic value creation – particularly around distributed energy resources (DERs) – has got a key role to play in enabling faster connections, ensuring the lowest possible cost in the expansion of dispatchable generation capacity, and the utilisation of grids.”

This signifies a paradigm shift – and a big opportunity for energy flexibility. It emphasises how the benefits of flexibility markets are shifting from avoiding grid upgrades to building better and smarter. That means more data and visibility to make informed decisions on capital investments. This will, in turn, encourage more advances in those markets and how they operate.

“Everything is only going to get louder in the next few years. In 2025, we therefore predict a lot more work on near real-time markets and the deeper integration of DER markets into today’s network monitoring and control systems,” says Jo-Jo.

Read more about the enduring need for flexibility

2. The UK will continue its focus on operational standardisation and interoperability to boost participation in flex markets

That deeper integration ties in with a big theme in the UK: standardisation and interoperability.

The Open Networks programme leads the UK’s shift to a smart and flexible power system. It includes a focus on standardisation and interoperability, to achieve a better user experience for DERs. Yet there are other projects in progress to enable more interoperability in specific parts of the flexibility workflow.

“Innovations – such as Flexibility Markets Unlocked or project BiTraDER in the UK – have the potential to open up the wider ecosystem to support flexibility,” shares Electron’s CPO, Nick Huntbatch.

“In 2025, some of these programmes will come to fruition. This will help with key challenges such as market access and coordination between markets.”

The onus is then on the UK’s distribution system operators (DSOs) to continue to implement and drive those markets.

“In 2025, Electricity North West Limited will continue to engage in initiatives to drive the growth of flexibility markets across our licence area and the flexibility ecosystem at large,” says Paul George, DSO Commercial Lead at Electricity North West.

The DSO is working on projects making it easier for DERs to connect and participate in flexibility markets.

“Our work on BiTraDER – in collaboration with Electron, AFRY, and LCP Delta – is just one example of a new market which aims to enable DERs on flexible connections to trade their curtailment obligations bilaterally with non-curtailable connections,” says Paul. “This will thereby increase the uptake of low carbon generation and boost value for existing customers.

“The peer-to-peer [BiTraDER] design is first of its kind. The two-way data flows, with close integration between our DSO systems and Electron’s market platform, is another step towards the interoperability that the industry needs for flex markets to flourish.”

3. The EU Network Code on Demand Response will advance

In Europe, the Network Code on Demand Response is in the works. This aims to help more flexible DERs to integrate and connect with the grid. It therefore encourages a market-based approach to help solve congestion issues.

“Over the last year, the EU market has made great strides, advancing flexibility through pilots such as MindFlex. This demonstrates the ability of flexibility to maintain a reliable grid,” says Shane Touhey, Electron’s Commercial Analyst.

“The Network Code is an important step in promoting fair competition, supporting renewables, and facilitating electricity trading. I’m pleased to see a market-based approach being recognised as the best way to unlock demand side flexibility.”

The topic of standardisation is still an open question. Some are calling for more guidance on this aspect of the code, to help streamline DER participation.

The European Union Agency for the Cooperation of Energy Regulators (ACER) will share a revised version of the code with the European Commission by March 2025.

“As we move into 2025, it’s time to move beyond pilots and I expect to see the network code guiding the market as it develops,” says Shane.

“Alongside the market fully leveraging proven technologies like market trading platforms, this will enable robust trading of flexible energy for a more stable and sustainable grid across the EU.”

Read more about the network code

4. FERC 2222 and 1920 signal a growing requirement on US utilities to integrate renewables into the grid

“Policy in the US is incentivising the integration of more renewables into the grid, says Ayan Kanhai Aman, Electron’s Policy and Markets Lead.

“From the Inflation Reduction Act to FERC Orders 1920 and 2222, all signs point to DERs becoming increasingly important as clean energy tools to help balance supply and demand.”

FERC Order 1920 requires US grid operators to plan new transmission infrastructure to 20-year timescales. They will also need to prioritise delivering more renewable energy and defending against extreme weather.

This encourages a more holistic approach to managing the grid for the long term. The integration of more DERs to take advantage of their flexible capacity and load shifting capabilities will therefore gain prominence.

“So, how do we integrate DERs, how do we do it in a manner that is efficient, both economically and environmentally?” asks Ayan. “We have to make it attractive for DERs to participate, and that means putting in place the right incentives.”

FERC 2222 is a step in the right direction. This order outs the onus on utilities to allow DERs access to electricity wholesale markets through aggregation of the assets – which feeds into the next prediction.

5. The ability and need to access new markets for DERs will only grow

“The US has yet to see the full impact of FERC order 2222,” says Nick Huntbatch, Electron’s Chief Product Officer.

“We expect further efforts to integrate aggregated DERs into the energy system in 2025 – and specifically the use of local flexibility markets to unlock the full potential of a wide range of DER types.”

In the UK, P415 recently amended the Balancing and Settlement code, enabling independent aggregators to access the wholesale market. In the EU, the network code encourages a market-based approach to flexibility – which is a growing trend.

“Though long predicted, it feels like 2024 was the first year that all flex assets were having to be optimised across multiple markets simultaneously,” says Mike Ryan, Commercial Director at Constantine Energy Storage.

“With six dynamic frequency markets, the intraday and day-ahead wholesale markets, the balancing mechanism, system price, balancing reserve, and – at the end of the year – quick reserve, the markets for flex assets have never been more complex. However, there still seems to be a split between which assets can access which markets.”

Mike expects this to resolve itself in the coming months.

“In 2025, I predict that we’ll see the start of all markets being accessible to all parties in the UK,” says Mike.

“If an asset can technically meet the market need, then it should be able to commercially participate. This is a better result for the end consumer, and a result that helps us deliver Net Zero.”

So, what’s required to improve market participation?

“We need to bring the system together,” says Ayan. “To bring the system together, you need the right tech. You need systems to talk to each other, which is all about interoperability, and it’s got to be more cost efficient than just building more assets.”

This is where learnings from the UK can help, with its focus on operational efficiency alongside capital investments – as well as a rising interest in the benefits of distribution system operation.

6. US utilities are starting to recognise the potential of distribution system operator (DSO) capabilities for leveraging DERs

“It’s an exciting time for the US, as power systems decarbonise,” says Electron’s CCO, Chris Broadhurst.

“We’re seeing increased interest in distribution system operator (DSO) models from the UK and Europe. US utilities recognise that there’s a growing need to be smarter with the grid, with DERs, and with its customers, to deliver a safe, low-cost, reliable network. The value that the DSO model can deliver is an attractive proposition in this context.”

Leveraging DERs is the key to a low-cost electrification of our power systems. The success of the DSO model in the UK demonstrates how US utilities can get a greater volume of DERs showing up and can still deliver strong returns.

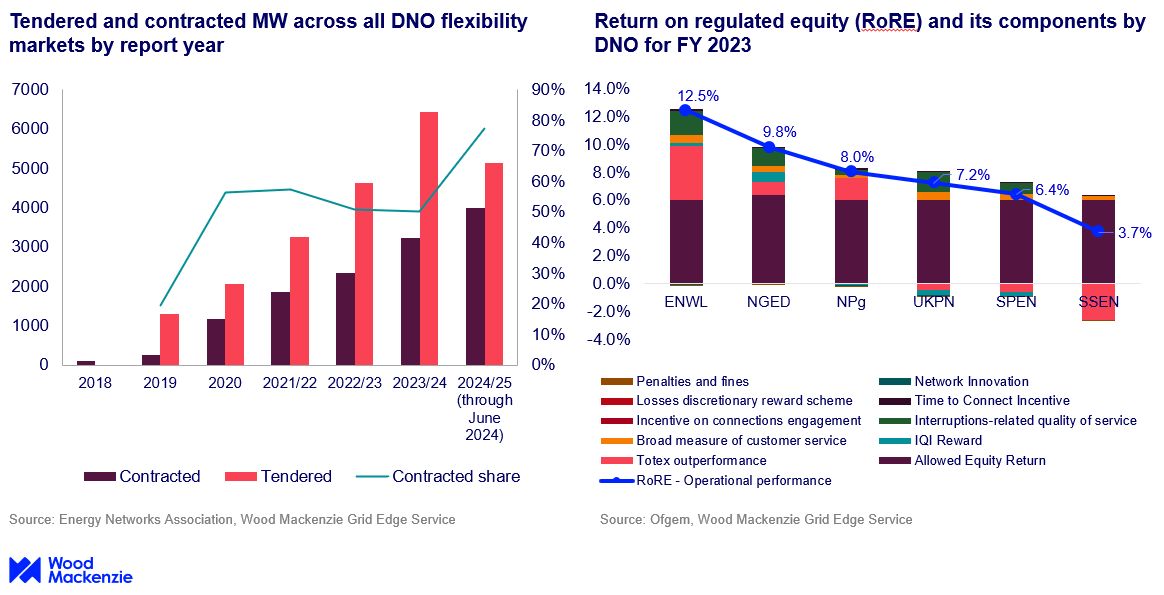

Wood Mackenzie has recently shared a breakdown of statistics which demonstrate the concrete benefits of this approach:

From technology and operating model to the customer experience, market designs, and incentives – like policy and regs – the DSO model encompasses many concepts that need to be defined for the US market. However, there are similarities and lessons from the UK that US utilities can draw on.