Decarbonising power systems to hit global Net Zero targets places ever increasing strain on the electricity networks, as both renewable energy sources and demand for electricity grow in significance. Energy flexibility has stepped up to provide a cost-effective solution to help meet this demand, providing value to all actors across the industry.

The lowest-cost route to Net Zero

The move to renewables is non-negotiable. It’s a government-set target, and that means system operators need to continue to enable the shift to clean electricity.

Renewable electricity can be produced at near zero marginal cost. The facilities built to generate renewable electricity have close to no operational costs when compared to traditional generation.

Electricity then must reach its end users – and that’s where the energy transition becomes costly. The distribution network needs to be upgraded to ensure the network can cope with the increased demand. The UK’s transmission grid operator, the ESO, published plans in 2022 to spend £54Bn on upgrading its electricity networks to handle new connections from offshore wind farms.

Reducing peak capacity expenditures

Paying to upgrade the network to cope with peak capacity – a capacity which is rarely reached – is expensive. That’s where energy flexibility excels, to better manage when and where that electricity is used.

The UK government’s Smart Systems and Flexibility Plan 2021 estimated that using flexibility to reduce the amount of costly network upgrades needed to meet that peak demand would cut system costs by £10bn a year by 2050.

Distribution Network Operators (DNOs) that take advantage of flexibility services as early as possible through flex markets will benefit sooner – and those reduced costs can benefit end consumers.

The cost of wasted energy – and its impact on consumers

End consumers bear the brunt of energy network costs. Finding more efficient ways to run the networks is therefore crucial to improving their experience and reducing their bills.

Alongside the cost of upgrades to the grid, consumers also pay for the wasted, curtailed electricity, due to grid congestion. Without introducing flexibility to power systems, that cost of curtailment of energy starts to mount up.

- Curtailed wind power in 2021 cost Great Britain £507 million – a 70% increase on the cost in 2020 and a record high.

- Carbon Tracker shared that curtailment in 2023 costs UK households an extra £40 a year, and that could increase to £150 in 2026.

- Across the Channel in Europe, curtailment is costing consumers an additional 71Bn euro a year.

Energy flexibility can therefore help lower those costs for consumers, and they can even get rewarded for taking part. Demand response programmes – such as the UK’s nationwide Demand Flexibility Service (DFS) – offer reduced bills in exchange for consumers using electricity at a different time of the day, to counter grid congestion.

In some instances, the consumers can even get paid to use that electricity. EDF Energy has shared that its customers could earn up to £100 credit over the 23-24 winter period in the UK, through the DFS.

The price of flexibility tenders

Then we come to the Flexibility Service Providers (FSPs). Consumers can be an FSP when taking part in demand response programmes. Additionally, much of the flexibility comes from generation and storage.

System operators regularly put out flexibility tenders, at varying amounts and values. In October 2023, UKPN announced its largest flexible electricity tender of 850MW to date– enough to power around 500k homes. ENWL put out a call for 400MW of flexibility at the same time, worth a total of £7 million to FSPs.

The value of revenue stacking

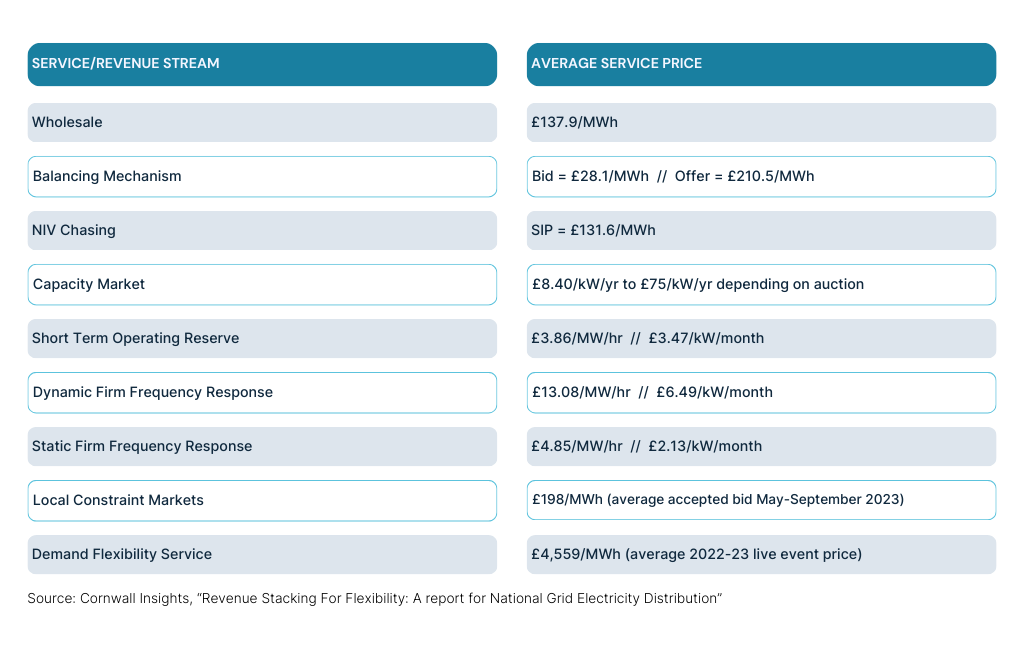

But accessing a single market limits the value that FSPs can obtain from offering up their flexibility services. Revenue stacking across multiple markets therefore could become key to helping FSPs maximise value from those different markets. Cornwall Insights’ analysis for the National Grid shares approximate service values from different markets:

Clearly, there’s a lot of value in energy flexibility and deploying flexibility markets for system operators, FSPs, and end users alike. However, we have a way to go before its full value can be realised. Although a record amount was tendered in 2022, only 44% of it was contracted, according to the Energy Networks Association.

The industry needs to work towards lowering barriers to entry for FSPs and improving the experience of all market actors to ensure they can access the full value that flex markets have to offer. Flexibility market platforms are one way to do this, to help boost participation and ensure there’s enough energy flexibility available to optimise grid capacity and keep the bills for end consumers low.

Want to learn more about how our multi-market platform, ElectronConnect, can maximise the value of energy flexibility? Book a call