The energy industry has long lamented consumers’ lack of engagement with their energy consumption.

This old cliché was that most consumers wouldn’t even switch suppliers to save £300. Today they can’t switch suppliers to save £300. And yet government polls show that a startling 82% of people said they had given either a lot, or a fair amount, of thought to saving energy in the home, and were willing to make changes to meet Net Zero but need better information on how this can be achieved affordably.

So, the incentives and forum for consumer engagement are in need of a solid rethink. And the most promising stage for both engagement and cost-savings is local flexibility markets. These are markets – such as those coordinated through our flex market platform, ElectronConnect – in which energy producers and consumers alike are incentivised to adjust their planned import or export of power to save costs and carbon.

What is temporal flexibility?

As more electric vehicles find homes on UK driveways, joined by heat pumps and solar and storage systems, increasingly engaged consumers are seeking to optimise their consumption, and therefore their bills.

Consumers are starting to take note that being flexible could be worth their while. The result so far has been a commensurate doubling in the availability of Time of Use tariffs.

Now, with energy bills at record highs and unlikely to abate any time soon, the government has waded in with “biggest electricity market reform in decades” that includes a proposal to enable all consumers to access “sharp” signals to consume at cheaper, greener times.

But, thus far, conversations have revolved around charging EVs overnight when demand is low, or charging up batteries when the sun is highest in the sky but before families come home from work and school. This is temporal flexibility.

Why is temporal flexibility important?

Temporal flexibility is important for balancing intermittent renewable generation and smoothing peaks in demand to mitigate the need for new generation that would only be required for 10-30 days a year.

We already can – and do – take this same flexible approach at commercial and industrial levels. Aggregators have packaged up and sold this type of energy flexibility to the grid for over a decade now.

However, when you consume is also only one part of the energy flexibility equation. The other part is where you consume.

Why is location important to flexibility?

Imagine a scenario in which Scottish wind farms are enjoying high output and generating at full capacity. At the same time London has a spike in demand. Great – London has a source of abundant renewable energy to deal with that spike, and the windfarms in Scotland have a buyer for their power. Right?

Yes, in theory. In reality, at both the transmission (long distance) and distribution (local) level, networks can become congested.

This congestion can go both ways. Supply congestion is when the generation that is being exported locally exceeds the network capacity. Demand congestion is when too much power is being demanded from the local network.

What problem does local flexibility solve?

Both forms of congestion put increased pressure on the network assets – the wires and transformers – which shortens the useful life of those assets. That results in higher grid costs or, frequently, the curtailment of supply or demand.

On the supply side, this curtailment wastes renewables, which are the cheapest, cleanest and most local form of power we have. On the demand side, curtailment can mean revenue loss for businesses and can threaten the roll out of the clean technologies required for Net Zero, such as EV charging stations.

Network congestion could be solved by massive expansion and upgrades of all networks at exorbitant cost. However, that’s not a realistic option. Although, some network expansion will be required, it is also vital that we minimise temporary congestion. That means being smarter about paying flexible demand to consume at the right time AND the right place.

What can be traded on local flexibility markets?

The possibilities for locational flexibility markets are vast.

For example, renewable generators in congested distribution grids might pay local consumers to use more power, or export less, at a certain time and location, to avoid curtailment and revenue loss. Essentially renewable generators would be paying to buy additional network access, but only when they need it.

The list goes on. An EV charging forecourt might seek to buy the right to charge more cars at once during peak charging demand from flexible local businesses.

Then we have other niche services. These are concerned with maintaining the frequency and power quality of the network (rather than only matching supply and demand volumes).

Moreover, local markets do not have to be limited to the distribution network. Industrial hubs could also be incentivised to locate near larger, transmission connected renewable projects. This would minimise strain placed on the ultra-high voltage network.

Such an arrangement could transform the unit economics of the major energy users of the future. Think vertical farming, electrolysis, or computationally heavy processes.

That level of innovation is exactly why a localised market-led approach is so advantageous.

What pricing challenges can a local flexibility marketplace help overcome?

Opponents of local pricing express concern over “postcode lotteries”. Indeed, why should consumers in one area have to pay more for power than consumers in another area?

This has been one of the key challenges to the concept of nodal pricing, that is currently gaining momentum. Indeed, nodal pricing is certainly one way of implementing local prices in a local energy flexibility market.

However, nodal pricing is a centralised approach to establishing locational value. It requires the operator in charge to set the price of using the grid at a particular time and location. The extent to which this pricing would reach into the distribution grid remains to be decided.

How can incentives help build flexibility?

We propose a symbiotic but different approach: locational incentives for flexibility – in other words, temporarily buying or selling additional access to the grid – and not power. In this approach, pricing would be upside only (i.e. no surcharges for the locationally challenged).

This makes sense since the flexible actions of consumers in one congested area of the grid help to save network reinforcement costs and renewable wastage for all consumers. Moreover, this form of local payments will, in turn, encourage investment in flexibility exactly where it is needed.

We believe that local flexibility markets could and should empower people and businesses to take their ideas and run. They should become price makers as well as price takers. They will be critical in allowing energy market participants to coordinate profitably.

What’s the potential value of European and UK local flexibility markets?

Flexibility was of little relevance in the old-world. Almost all of our energy came from coal and gas. It was connected at a national level, and was available to turn up or down demand.

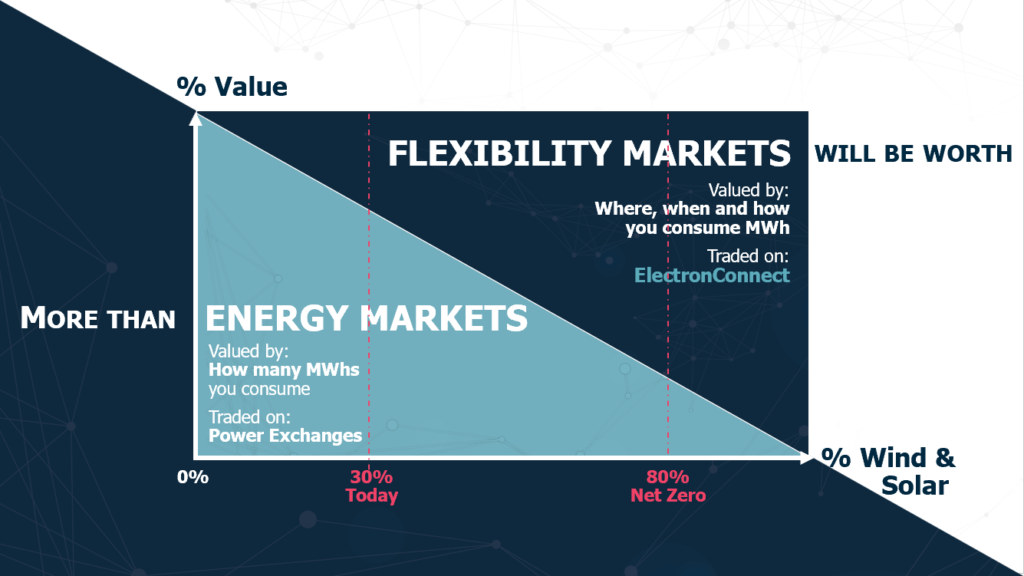

In that world, it made sense to charge consumers based on total MWhs consumed. Yet, this form of billing persists today, when over 40% of our power is already produced by wind and solar at zero marginal cost, and is occasionally in surplus to demand.

But, as we transition to around 80% renewable generation, we will frequently have more than enough zero marginal cost electricity. Time and place will be the limiting factors, rather than fossil fuel supply.

When and where energy is used will soon be a bigger factor in pricing than how much energy is used.

In other words: flexibility markets tomorrow could be worth more than energy markets as we understand them today.

Want to learn more? Reach out to our team of experts.