ElectronConnect in numbers

0

GW/h

Cumulative reserved flexibility volume

£

0

m

Cumulative reserved flexibility value

0

Flexibility providers registered

Trusted by

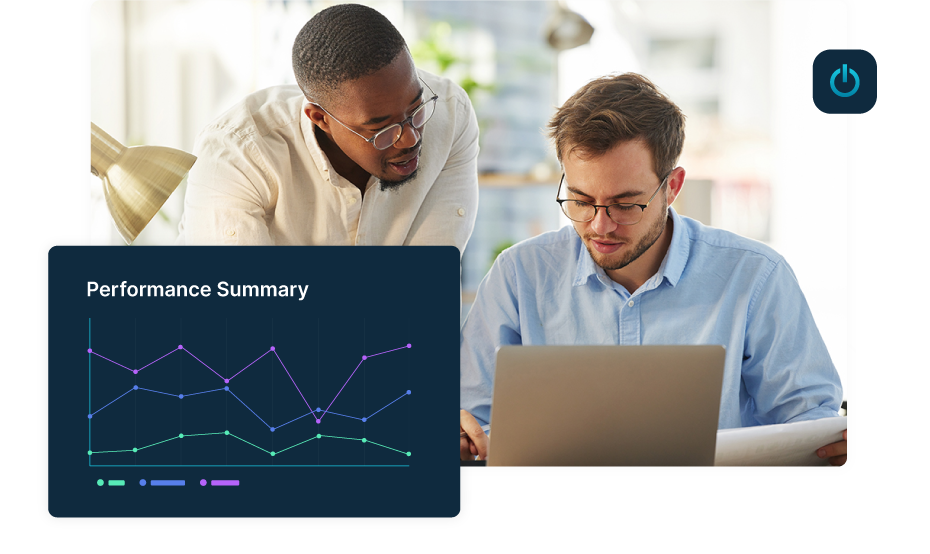

Working together

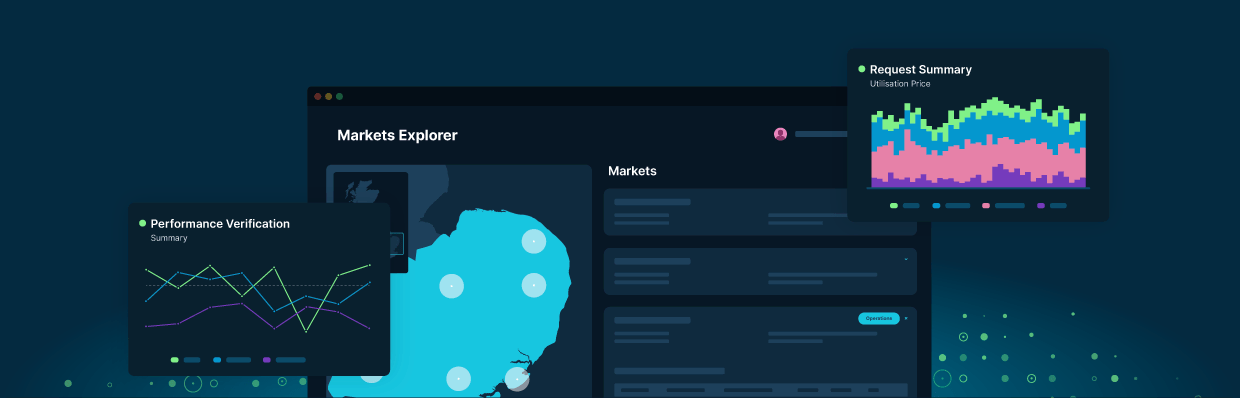

For a better futureWhether you’re buying flexibility or providing grid services, use a marketplace that suits your needs.

Let’s accelerate the transition to Net Zero energy together.