Electron’s Flex at Scale 2024 event brought the energy industry together to debate some of the clear actions that will help ensure a resilient grid into the future, with a focus on the benefits of flexibility markets. Here are three of the high-level takeaways from the day.

Follow Electron on LinkedIn for more event write ups in the coming weeks.

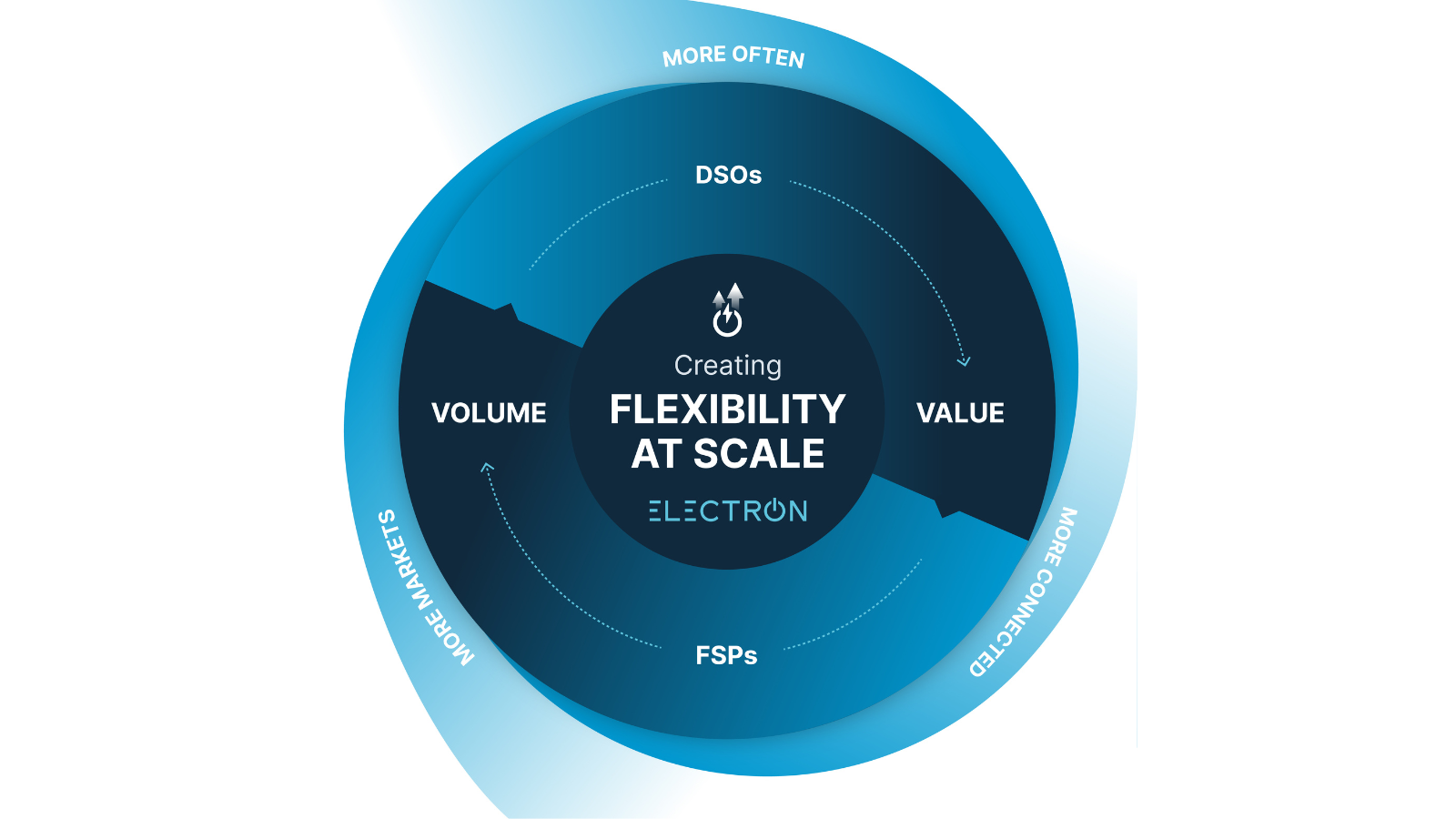

1. The value and volume of flexibility markets is interdependent

Scaling flexibility markets revolves around introducing more value to capture more volume and using that volume to release more value.

These two components reinforce each other to create a flywheel effect whereby, as one grows, the other does the same. This allows flexibility to gain momentum.

“The flywheel concept resonates with me,” said Alex Howard, Head of Flexibility Markets at UK Power Networks, during the event.

“Providers and system operators are trying to generate momentum, each believing that if they do that, then they will see the benefits eventually. […] I think we all need to lean into that flywheel analogy in whatever way our businesses can.”

There are other ways to support this emerging momentum. Electron’s previous whitepaper on the open-ecosystem approach to scaling flexibility illustrates how the landscape and systems around markets can be arranged to support flexibility at scale.

Yet it’s system operators and flexibility service providers (FSPs) that trade in these markets. Having their buy-in and solving for the value that they determine today is crucial to ensure that volume and value can continue to grow into tomorrow’s grid. Flex at Scale 2024 demonstrated that the appetite is there.

Read more about the value / volume thesis

2. There is still work to do on data interfaces between markets to promote access and highlight where further value can be found

Data was, unsurprisingly, a key topic that surfaced throughout the day’s discussions. Scaling flexibility requires a much greater degree of operational efficiency for both system operators and flexibility service provides. Data is the key to unlocking it. This means accessing the right data, at the right time, and with less manual intervention.

Forecasting is becoming more granular, moving to day-ahead and near real time. This timing-shift aligns with the needs of many of the FSPs that are still on the sidelines of distribution-level flexibility markets, so more can participate and start to see value.

Data is also essential to understanding those load flows and to help all market participants recognise where there’s potential value.

That accuracy and transparency of data helps refine where those opportunities are for FSPs. It shines a light on where the value lies, with a better understanding of the performance of their assets.

This again reflects the open-ecosystem approach to flexibility. More portability of data between parties, creating more transparency, and removing friction and barriers to entry will help to boost volumes of flexible assets participating in flex markets.

3. Involving consumers and their electrified assets in the right way is vital for flexibility volume

Consumer assets – such as heat pumps and EVs – are a vital part of this energy transition. Unlike utility scale, pure-play flexibility, these dual-use assets have to want to interact with the grid. The question of how actively they need to engage vs. creating trust for a more passive, delegated participation was raised across panels.

For more consumers to actively participate, they need to see more value. This covers both economic value and also the customer value proposition.

Retailers have a responsibility to provide consumers with the ability to be flexible through the products provided, aiming to benefit their lifestyle.

For example, Octopus Go, Octopus’s EV time of use (ToU) tariff, enables EV owners to charge their vehicles at cheaper times of the day.

However, as recently debated by Electron’s Head of Product, Nick Huntbatch, ToU tariffs run the risk of consumer herding. They are therefore no silver bullet to bolstering the volume of flexibility available, without the support of dynamic locational, flexibility markets.

“The ESO sees flexibility as an essential tool in managing the electricity system, but are increasingly looking to the market to help shape the services that it needs to do so,” said Lois Clark, Flexibility Market Development Manager, National Grid ESO, during the first panel session.

“Flexibility markets are here to help us manage the network, and ultimately drive better value for consumers.”